Cost estimates, standard deviations and fixed fees

Our legal cost estimates are based as much as possible on our historical billing data. By using statistical methods our estimates exclude the common human tendency of underestimating the final all-inclusive cost of future work. We do this by categorising recurring service types and rating them for risk and complexity. We then calculate the following.

- The average price for a type of service adjusted for risk and complexity

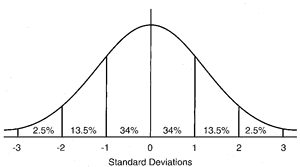

- Standard deviation (a measure of the typical difference between final bills and the average bill)

- The normal or range of final bills (a bell curve)

These mathematical concepts are behind our automated cost estimator which ask clients a series of questions about the new matter so we can identify the service type needed, assign it a risk rating, and calculate an estimate. We can only use this algorithmic method for the regular or recurring work we do.

Our goal for the variability margin or ‘firmness’ of our estimates, automated or not, is plus or minus 10% as the standard deviation. So for example, if our estimated legal cost for a service is $1,100 it is because we assess the greatest likelihood (68%) is that the final tax invoice will fall within the range $990 to $1,210. With this approach, your final bill is just as likely to be below, as above, our initial estimate.

If you are content with the amount of our estimate but want to convert it to a ‘fixed fee’ arrangement, we might agree to that in exchange for a 15% to 25% premium to the estimate and a ‘fair use’ addendum to our costs agreement with you. Fixed fee billing is more expensive because fixed fee clients generally interact differently and in a way that is often more time-consuming for the lawyer.

Under section 308 of the Legal Profession Act a law practice must give an estimate of total legal costs or if necessary an estimated range of costs (with an explanation of the major variables affecting cost). A law practice must also give notice of any substantial change to the costs estimate or estimated range. This means that notwithstanding the work the goes into our initial cost estimates, revisions may occur because future events or realities emerge that were not factored in when the initial cost estimate was calculated.