Cost estimates, standard deviations and fixed fees

Our legal cost estimates are based primarily on our historical billing data. Using statistical methods, our estimates avoid the common human tendency to underestimate the final all-inclusive cost of future work. We achieve this by categorising recurring service types and rating them for risk and complexity. From this, we calculate:

- The average price for each service type, adjusted for risk and complexity

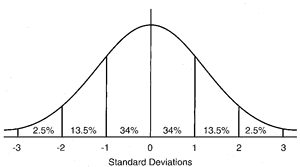

- Standard deviation (measuring the typical difference between final bills and the average bill)

- The normal distribution range of final bills (represented by a bell curve)

These mathematical principles power our automated cost estimator, which asks you a series of questions about your new matter. This helps us identify the required service type, assign a risk rating, and calculate a reliable estimate. We can only apply this algorithmic method to our regular or recurring work.

For all our estimates, whether automated or not, we aim for a variability margin or ‘firmness’ of plus or minus 10% as the standard deviation. For example, if our estimated legal cost for a service is $1,100, there’s a 68% likelihood that your final tax invoice will fall between $990 and $1,210. With this approach, your final bill is equally likely to be below or above our initial estimate.

If you accept our estimate but prefer a ‘fixed fee’ arrangement, we may agree to this for a premium of 15% to 25% above the estimate, plus a ‘fair use’ addendum to our costs agreement. Fixed fee billing typically costs more because fixed fee clients tend to interact differently, often requiring more of the lawyer’s time.

Under section 308 of the Legal Profession Act a law practice must provide an estimate of total legal costs or, if necessary, an estimated range of costs (with an explanation of the major variables affecting cost). A law practice must also notify you of any substantial change to the costs estimate. This means that despite the careful work that goes into our initial cost estimates, revisions may occur if unforeseen circumstances emerge that weren’t factored into the original calculation.